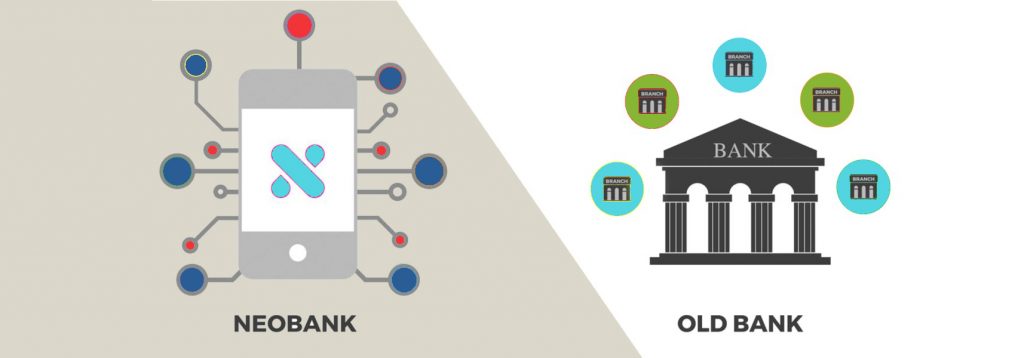

In recent years, the rise of neobanks has disrupted the traditional banking industry. NeoBanks are digital, mobile-only banks that offer financial services exclusively through mobile applications or online platforms. On the other hand, Traditional Banks are physical brick-and-mortar institutions that have been around for centuries. In this article, we’ll take a detailed look at the features, benefits, and drawbacks of NeoBanks and Traditional Banks.

Features of NeoBank vs Traditional Bank

Neobanks offer a range of features that set them apart from traditional banks. For one, Neobanks are entirely digital and mobile, meaning that they don’t have physical branches that customers can visit. Neobanks typically offer free accounts, no minimum balance requirements, and lower fees than Traditional Banks. They also provide customers with 24/7 access to their accounts, allowing them to manage their finances on-the-go.

Traditional banks, on the other hand, provide a range of services beyond just banking. They offer a variety of financial products, including credit cards, mortgages, and insurance policies. Traditional banks also have physical branches that customers can visit to speak with a representative and receive assistance. However, traditional banks often have higher fees and more stringent requirements, such as minimum balance requirements.

Benefits of NeoBank vs Traditional Bank

NeoBanks have many benefits over traditional banks. One major advantage is their convenience. Customers can open an account in minutes, without having to visit a physical branch or fill out paperwork. Neobanks also offer real-time notifications and budgeting tools, making it easier for customers to stay on top of their finances. Additionally, N%title%eobanks often provide higher interest rates on deposits, giving customers a better return on their savings.

Traditional banks, on the other hand, have a long-standing reputation for stability and reliability. They often offer more extensive financial product offerings, and their physical branches provide customers with a more personalized banking experience. Traditional banks are also insured by the FDIC, which provides up to $250,000 in coverage for each account holder.

Drawbacks of NeoBank vs Traditional Bank

While NeoBanks have many benefits, they also have some drawbacks. One major disadvantage is the lack of physical branches, which can be a turn-off for some customers who prefer in-person interaction. NeoBanks also have limited product offerings, often only providing basic banking services such as checking and savings accounts.

Traditional banks, on the other hand, are often associated with higher fees and more stringent requirements. They may also have longer wait times for customer service, and their online platforms may not be as user-friendly as neobanks.

In conclusion, NeoBanks and traditional banks each have their own set of features, benefits, and drawbacks. NeoBanks offer convenience, lower fees, and 24/7 access to accounts, while traditional banks provide a wider range of financial products and a more personalized banking experience. Ultimately, the choice between neobanks and traditional banks depends on the individual’s preferences and financial needs. However, with the continued rise of neobanks and their innovative services, it’s likely that we’ll see a shift towards a more digitally-focused banking industry in the years to come.

- AI’s Inevitable Takeover: How Fintech and Tech Experts Must Adapt Now - January 22, 2025

- AI in Fintech: An Enabler or a Disruptor? - January 20, 2025

- Importance of Payment Service Providers (PSPs) - June 14, 2023

Pingback: Digital Wallets Digital Wallets,payment Sollutions,wallets,rise Of Digital Wallets,software Applications » Global Fintech Forum

Pingback: Top 10 Neobanks in India. - FintechForums